work opportunity tax credit questionnaire reddit

Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age.

Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program.

. By creating economic opportunities this program also helps lessen the burden on other government assistance programs. This varies by group although most groups have a cap of 6000 so employers can claim at most a 2400 tax credit for each employees first year. WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment.

There is a cap on the amount of WOTC-eligible wages per qualified employee. The application asks for my Social Security Number but I feel uneasy providing it this early in the job application process considering that identity theft is on the rise. I feel like Im not getting a call back to any of these companies I apply for that ask the WOTC questions.

The very first question is Are you under age 40 How is this legal. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. A couple of jobs I have applied for have required me to complete the Work Opportunity Tax Credit as part of my application process.

These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. This notice provides transition relief by extending the 28-day deadline for employers to submit a certification request for an individual who begins work on or after. Work Opportunity Tax Credit.

WOTC Improve Your Chances of Being Hired. The Work Opportunity Tax Credit WOTC can help you get a job. For example if an employer hires someone who graduated from college in the past two years they will get a tax credit.

This tax credit may give the employer the incentive to hire you for the job. What Is the WOTC Program. Below you will find the steps to complete the WOTC both ways.

This tax credit program has been extended until December 31 2025. As part of the application process we ask that you complete a short questionnaire in order to assess eligibility for the Work Opportunity Tax Credit Program WOTC. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

In general understanding tax credits can make a huge difference in whether you owe money come tax season or get a larger return. It also says that the employer is encouraged to hire individuals who are facing barriers to employment. This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training.

What is the Work Opportunity Tax Credit Questionnaire. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. Optimizing on these opportunities will depend.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that. I kinda feel like its unfair that they.

Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for. The federal government uses the tax credits to incentivize employers to hire from specific groups. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Completing Your WOTC Questionnaire. WOTC is not only intended to incentivize employers but provides considerable benefits to your community.

Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. Some companies get tax credits for hiring people that others wouldnt. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

Lately when I am applying for jobs many companies have me me fill out this application for WOTC so the company can see if they can get a tax break if they hire me. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. Essentially employers will get tax credits if they higher employees from specific groups.

This questionnaire will not. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. Felons at risk youth seniors etc.

The WOTC is a non refundable tax credit that can be carried back up to one year or carried forward up to 20 years. The employee groups are those that have had significant barriers to employment. Its called WOTC work opportunity tax credits.

Since 1996 the federal government has used the Work Opportunity Tax Credit program to reduce the federal tax liability of employers who hire individuals from groups that often face significant barriers to employment. The Department of the Treasury and the Internal Revenue Service IRS issued IRS Notice 2021-43 Work Opportunity Tax Credit WOTC Transition Relief under Internal Revenue Code 51 effective August 10 2021. Make sure this is a legitimate company before just giving out your SSN though.

There are two sets of frequently asked questions for WOTC customers. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. It asks for your SSN and if you are under 40.

Questions and answers about the Work Opportunity Tax Credit program. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. The answers are not supposed to give preference to applicants.

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. The Work Opportunity Tax Credit WOTC is a federal tax credit that can be significant for many employers but many may not know how it works or can impact their financials. It is a Work Opportunity Tax Credit.

Im trying to apply for a part-time retail job over the summer.

Work Opportunity Tax Credit Target Groups Infographic Cost Management Services Work Opportunity Tax Credits Experts

Cms Work Opportunity Tax Credits Wotc Newsletter February 2022 Cost Management Services Work Opportunity Tax Credits Experts

Start Working From Home Incomefromhomeideas Work From Home Companies Earn Money From Home Work From Home Jobs

Available Jobs Near Prince Edward Island Search Job Bank

17 Best Freelance Websites And Apps To Find Work In Canada In 2022 Savvy New Canadians

The Work Opportunity Tax Credit Wotc In Utah Cost Management Services Work Opportunity Tax Credits Experts

Wotc In The News Reintroduction Of The Military Spouse Hiring Act Cost Management Services Work Opportunity Tax Credits Experts

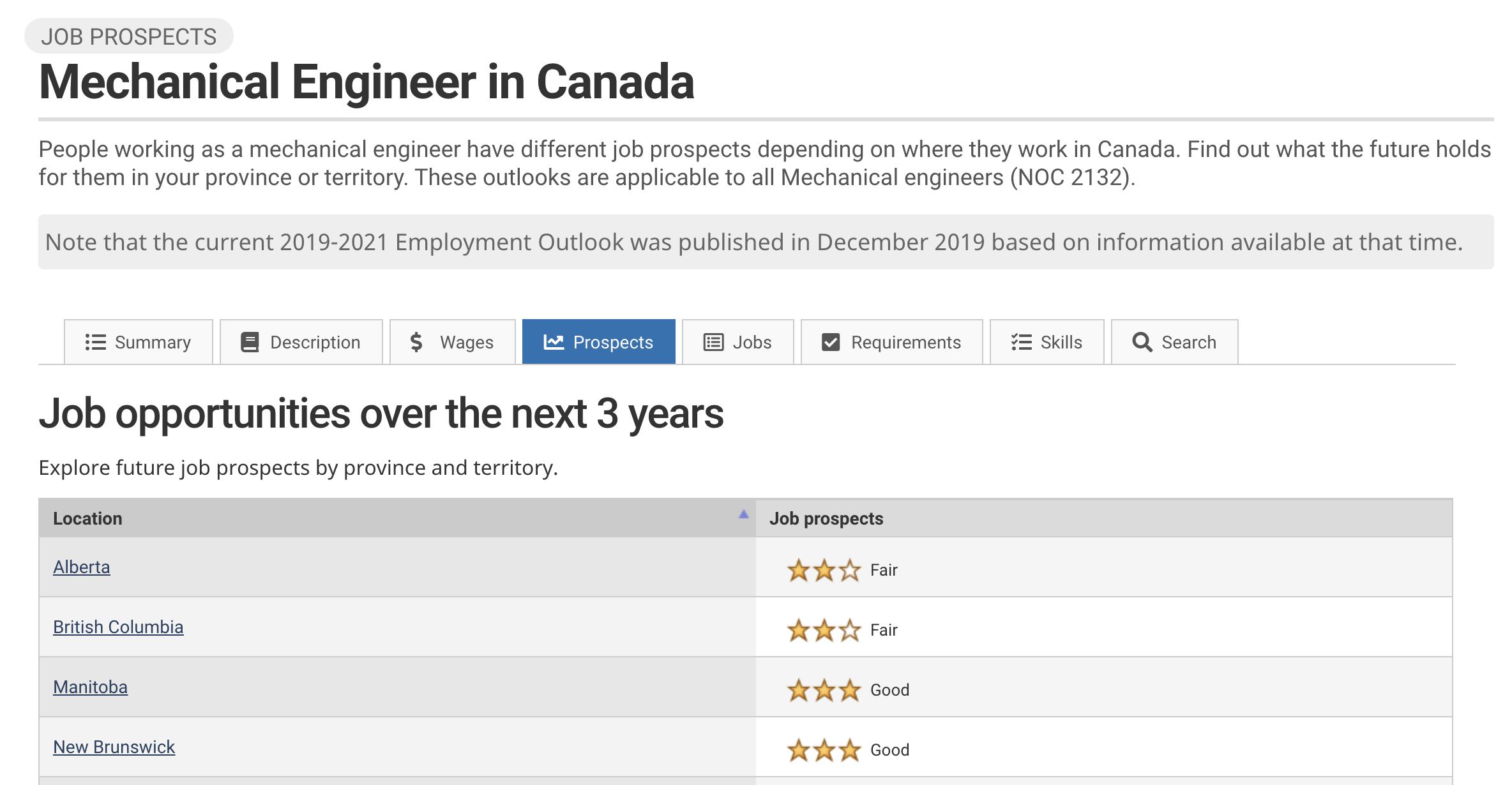

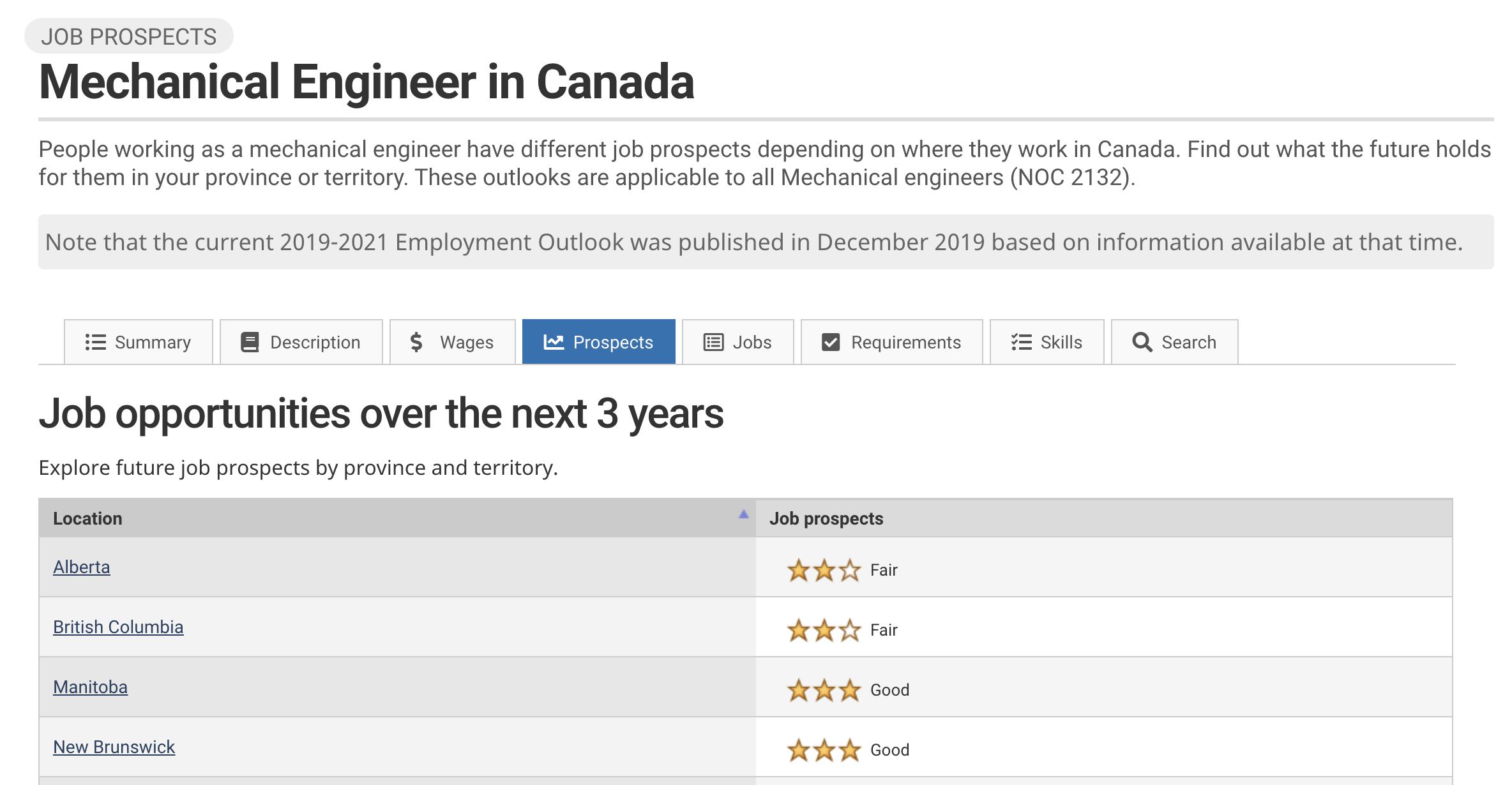

Canada Engineering Job Market Analysis For Newcomers Arrive

Work Opportunity Tax Credit Target Groups Infographic Cost Management Services Work Opportunity Tax Credits Experts

Cms Work Opportunity Tax Credits Wotc Newsletter February 2022 Cost Management Services Work Opportunity Tax Credits Experts

The Scout Mindset Why Some People See Things Clearly And Others Don T Galef Julia 9780735217553 Books Amazon Ca

Cms Work Opportunity Tax Credits Wotc Newsletter February 2022 Cost Management Services Work Opportunity Tax Credits Experts

Do Olympic Sponsorship Deals Work Experts Weigh In Bnn Bloomberg

Cms Work Opportunity Tax Credits Wotc Newsletter February 2022 Cost Management Services Work Opportunity Tax Credits Experts

Government Seeks Rs 13 000 Crore Surplus From Rbi Central Bank Finance Financial News

Work Opportunity Tax Credit Statistics For Connecticut Cost Management Services Work Opportunity Tax Credits Experts

Eyewitness News On Twitter Spring Cleaning Student Loans Debt Relief

Wotc Questions Can Staffing Agencies Take Advantage Of The Work Opportunity Tax Credit Cost Management Services Work Opportunity Tax Credits Experts